Robots and automated machines are going to put humans out of jobs. It has already started and may take a decade or two for a robot take over of job market.

If humans are jobless, they won’t have any income and in this case they won’t be paying income taxes. But if there are no taxes, the current system of governments will collapse.

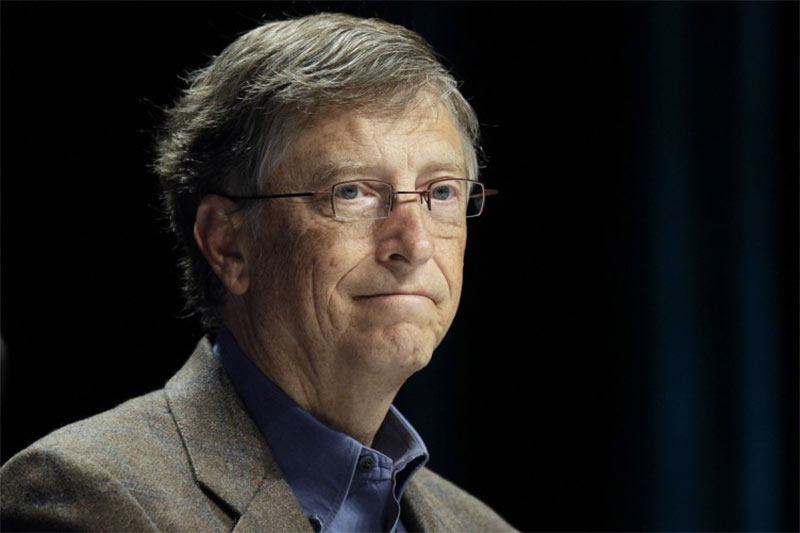

For that reason former Microsoft boss and business magnate Bill Gates believes robots and machines should pay their share.

Robots to pay Taxes:

In a recent interview with Quartz he said that “If a human worker does $50,000 worth of work in a factory, that income is taxed and you get income tax. Similarly If a robot comes in to do the same thing, you’d think that we’d tax the robot at a similar level.”

Gates suggests that the money could come from the the savings of the companies by not employing humans. Moreover, tax could also be levied against the firms that create robots and machines that steal human jobs.

Where this tax will be used?

The main purpose of tax collection is to make the lives of people better. In the same manner the tax collected from machines could be used to help people who’ve lost their jobs to automation.

It could also fund training for positions that require human empathy and understanding, like provide care to children, elderly and people with special needs.

You can’t just give up that income tax, because that’s part of how you’ve been funding that level of human workers – Bill Gates

People Shouldn’t be Afraid of Innovation:

He further said that people shouldn’t be afraid about what innovation is going to do to them, rather they should feel enthusiasm. Innovation appears in many forms and it should have positive effect on the society.

Companies don’t like to pay Taxes:

Surely, it’s a striking position from the world’s richest man but the corporate sector won’t like his ideas very much. However governments can play an important role in this by ensuring that humans who lost jobs to automation are provided for.