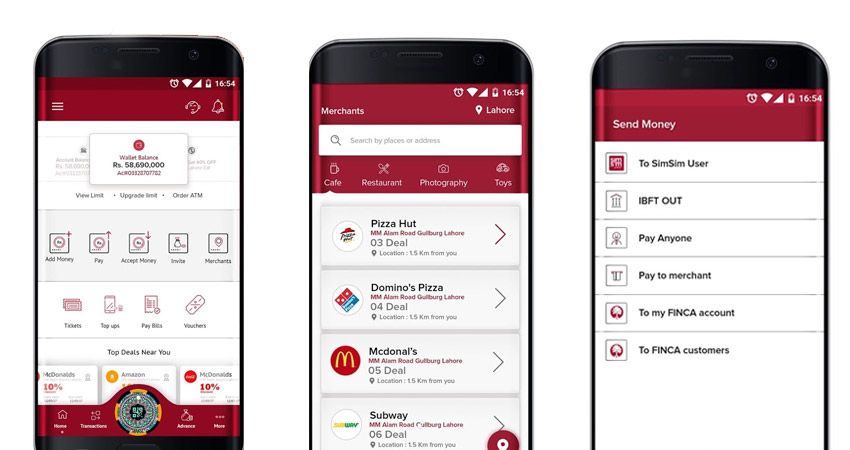

FINCA Microfinance Bank, one of the fastest growing microfinance banks in Pakistan, in partnership with Finja, internationally funded FinTech startup, announced the movement to make digital commerce and payments free in Pakistan. SimSim,a mobile payment platform, was introduced atits launch event last night at Mohatta Palace, Karachi. The event was attended by major industry stakeholders, government officials, artists, tech enthusiasts and media personnel.

Finja, the Fintech partner, developed the technology to enable anyone with a valid CNIC to open a remote zero account in less than one minute through their smartphones. As a consequence, FINCA will broaden its outreach to multiple consumer segments including the financially excluded and under-served customer segments.

Why SimSim?

SimSim will give people access to friction-less payment options directed towards a diverse pool of merchants. It intends to act as a catalyst for financial inclusion and shall spur digital payments by making even the smallest ‘payment event’ free i.e. as low as one rupee.This open API platform allows any online business to integrate and become a part of the SimSim ecosystem. Moreover, in the near future, individuals will also be able to seek credit and buy insurance through the SimSim platform.

SimSim is also connected to other banks in Pakistan though 1-Link for instant money transfers. It is available for both Android and iOS smartphones.

While praising the initiative,Executive Director BPRG State Bank of Pakistan, Mr.Syed IrfanAli said,“the efforts of the SimSim team should be commended for creating a platform which offers ease of access to financial services. In particular, it has minimized the need of transaction fee policy which will encourage increased usage of digital financial services at the consumer end. It is also important for all digital service providers to pay special attention to customer protection rights and customer data protection when deploying new products and services in the evolving space of digital financial service”.

“SimSim will enable FINCA Pakistan to broaden its reach to multiple consumer segment including financially un-served and under-served customer segments in a sustainable manner by enabling smartphone users to instantly open a mobile wallet with FINCA and transact digitally”, said Andrée Simon, Chief Executive Officer of FINCA Impact Finance

“SimSim, we believe, will transform and improve the lives of people by giving them financial identity and the power to change their lives”, said Mr. M Mudassar Aqil, CEO of FINCA Microfinance Bank Limited.

While talking about SimSim, Qasif Shahid, CEO of FINJA, said that,” SimSim is not just an app but is a free payment movement to transform Pakistan. Come join this movement and break free!”