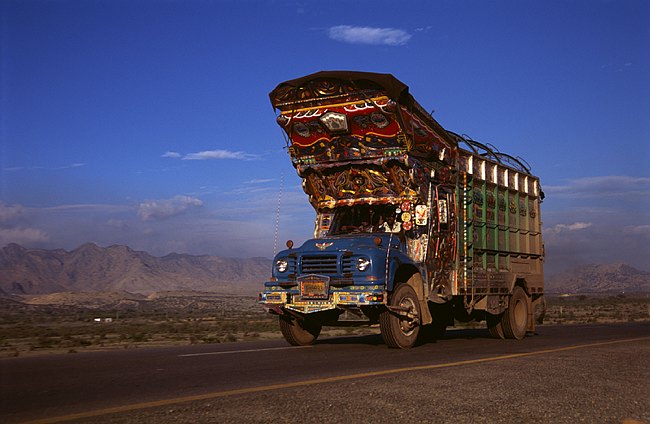

Trukkr, a Pakistani startup, revealed on Tuesday that it has secured $6.4 million in a seed round to develop as a fintech (financial technology) firm, offering financing solutions to truckers. Accion Venture Lab and Sturgeon Capital in the UK led the investment, with participation from angel investor Peter Findley, Haitou Global in the US, and Bahrain-based Al Zayani Venture Capital.

The business has previously declared plans to raise $600,000 in early investment in 2021. Also, according to Crunchbase statistics, the business had previously raised loans in 2021 and a pre-seed round in 2019.

Sheryar Bawany, Mishal Adamjee, Haji Ali, Waqas Khatri, and Kasra Zunnaiyer founded Trukkr in 2019 with the intention of bringing shippers and truckers together. The business has lately, nevertheless, changed its attention to a financial model.

According to the firm, only around 5% of trucking companies that use Trukkr’s platform have access to financial services, and they sometimes have to wait up to 90 days for payment for services done. As a result, businesses are unable to fund expenditures such as gasoline, tolls, and truck upkeep.

Small truckers that join huge fleets of corporations to obtain cargo to export, on the other hand, receive partial compensation from big companies, generating detrimental inefficiencies for small drivers.

It is reported that the business has obtained a non-banking financial institution (NBFI) registration from the Securities and Exchange Commission of Pakistan (SECP). The startup’s concentration on fintech does not imply that it will abandon the marketplace model completely.

Trukkr claims to have added more than 20,000 transportation firms to its network in the last year. Sheryar further stated that they have avoided aggressively increasing on the back of discounts and are hence more sustainable.

The business intends to use a portion of the cash from the current round for loans and will collaborate with banks in this respect. It also intends to expand its services and raise a larger Series-A round this year.