Pakistan’s first free mobile wallet, SimSim has received regulatory approval from the State Bank of Pakistan. The approval was granted under the Branchless Banking Regulation framework formulated by SBP.

SimSim is collaboration between Finca Microfinance Bank Limited and Finja. This is the first time a Bank and a Fintech, acting as the super-agent of the bank, have partnered to create a digital financial product.

What is SimSim?

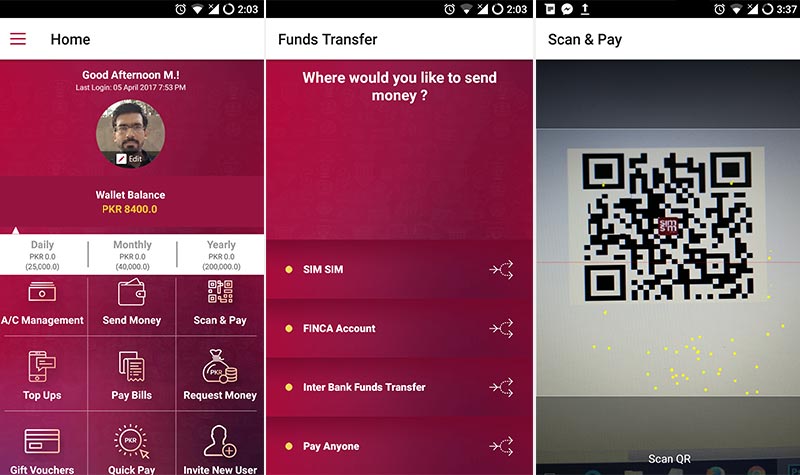

SimSim is a mobile wallet application that allows you to make direct P2P payments. It also features QR code based payment system, which is quite unique for Pakistan.

Morover, you can use the SimSim account to pay utility bills, mobile top-ups, send funds, buy gift cards and make online payments for popular websites.

The mobile wallet is a highly innovative, automated process which relies on NADRA integration and machine learning. Anyone with a valid CNIC can create a SimSim branchless bank account using their internet-enabled phones.

SimSim is not simply a product or an app, rather it is a movement to free digital commerce in Pakistan.

– Qasif Shahid, CEO Finja

SimSim connects to other banks through 1-Link for instant transfers, while ATM cards are available for cash withdrawals. Payments through SimSim are free for the receiving and sending users with their mobile numbers acting as bank account numbers.

Transactions worth PKR 600 Million during Beta Launch:

SimSim successfully completed a beta pilot prior to the formal approval from SBP, and recorded PKR 600 Million in transactions, 30,000 in self-registered mobile wallet accounts and a retail network of 500 participating merchants.

You can read our full review of the SimSim mobile wallet by following this link, where we have also mentioned all the pros and cons of this new service.

How to get SimSim?

To be a part of the SimSim network, all anyone has to do is download the app from the Apple App Store or Google Play Store. You will need also need a valid CNIC card and a working mobile number in order to setup your wallet.